Harvard University Complete Information

Types of Aid

Harvard University is one of the most renowned educational institutions in the world. At Harvard University, students pay over $70,000 a year to attend classes. Despite this high price tag, many students receive financial aid from multiple sources to help pay for their education at Harvard.

Grants

Scholarships are awarded based on merit and are not loans. They do not have to be repaid but can be used for tuition, fees and room and board.

Most scholarships at Harvard University are awarded by the university or outside sources (such as foundations). For example, suppose you're a first-generation college student from a low-income family and meet certain criteria set forth by Harvard. In that case, you may qualify for its Dean's Scholarship Program, which provides $4 million annually in financial aid for those who otherwise couldn't afford it.

The National Merit Scholarship Program is one example of an organization that awards scholarships to high school students who score well on the PSAT, SAT and ACTs. Other civic organizations like Rotary International also offer scholarships based on academic performance, community service or both.

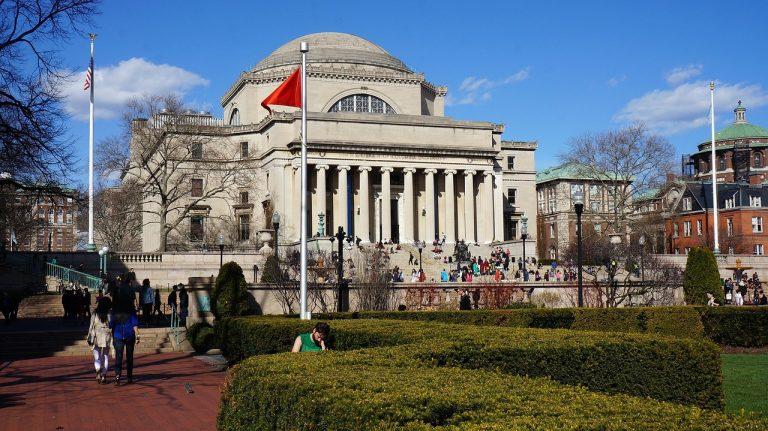

Explore University

Work-Study Programs

Work-study programs are available to students whose families earn less than $80,000 annually. To be eligible for a work-study job and to apply, you must be enrolled in at least six credits and complete the FAFSA.

Federal and state grants

Federal and state grants are need-based, meaning you must demonstrate financial need to qualify for them. The U.S. Department of Education awards Federal Pell Grants, and they're available to undergraduate students who have not yet earned their first bachelor's degree (such as those pursuing a second bachelor's or master's).

The amount you receive depends on your level of income as well as how much money is allotted for each year by Congress; it can range from $619 per year up to $5,920 per year at Harvard University.

The federal government also provides Supplemental Educational Opportunity Grant (SEOG) awards through its Title IV programs: Federal Work Study, Perkins Loans, Stafford Loans or PLUS Loans; however, they do not require any repayment after graduation like loans do - so don't let this scare you away from applying!

Student Loans

Student loans are a popular form of financial aid at Harvard. Federal Direct Subsidized and Unsubsidized Stafford Loans are awarded based on your demonstrated need, while Harvard loans are awarded based on your academic performance.

- Federal Direct Subsidized Stafford Loans: Students with demonstrated financial need who borrow money to help pay for college may be eligible for this loan, which carries a low-interest rate and comes in the form of a grant or work-study award. Maximum amounts: $3,500 for first-year, $4,500 for sophomores, and $5,500 for juniors and seniors.

- The amount you can borrow is determined by your school's cost of attendance minus any other funds you receive as part of your financial aid package (like scholarships). A student who receives subsidized loans will have no payments until after graduation; however, interest still accrues during school years and must be paid back when the loan becomes due within ten years after graduation or dropping below half-time enrollment status.

- Federal Direct Unsubsidized Stafford Loans: Maximum amounts: $5,500 for first-year, $6,500 for sophomores, and $7,500 for juniors and seniors.

Parent Loans

Federal Direct PLUS Loans are an option for parents who want to borrow money to help pay for their children’s education. These loans offer flexible repayment terms and low-interest rates but don’t come with any forgiveness programs or repayment options that allow you to repay your loan over time. If you take out a federal PLUS Loan, you must repay the full amount within ten years of graduating from college or withdrawing from school. Suppose your child does not graduate within six months after starting school. In that case, you will have to repay these loans immediately, even if your child transfers schools or leaves without graduating!